Ird Mileage Rate 2025 Nz - Different vehicle types are entitled to different mileage rates. The table of rates for the 2025/2023 income year for motor vehicle expenditure claims. IRS Mileage Reimbursement Rate 2025 Recent Increment Explained, Mileage rate 2025 ird nz. Every year the commissioner of the inland revenue sets the motor vehicle kilometre expense rates for businesses.

Different vehicle types are entitled to different mileage rates. The table of rates for the 2025/2023 income year for motor vehicle expenditure claims.

Irish Mileage Rates 2025 Aimil Ethelda, The tier 1 rate which applies to the first 14,000 km is set at $0.76 per kilometre, while the tier 2 rate which applies where running exceeds 14,000 km is set at $0.26 for petrol or. You can pay a cash allowance to an employee for travel between home and work.

IRS increases mileage rate for remainder of 2025 Local News, The tier 1 rate which applies to the first 14,000 km is set at $0.76 per kilometre, while the tier 2 rate which applies where running exceeds 14,000 km is set at $0.26 for petrol or. New zealand's inland revenue (ir) has just released its vehicle kilometre (km) rates for the 2025 income year, and it’s not good news, particularly for employers who will need.

Ird Mileage Rate 2025 Nz Del Gratiana, Use the tier 1 rate for the business portion of the first 14,000 kilometres travelled by the. The tier 1 rate which applies to the first 14,000 km is set at $0.76 per kilometre, while the tier 2 rate which applies where running exceeds 14,000 km is set at $0.26 for petrol or.

2025 IRS Mileage Rate Guide for Lyft Drivers Everlance Blog, Make sure you’re claiming the right rate! Different vehicle types are entitled to different mileage rates.

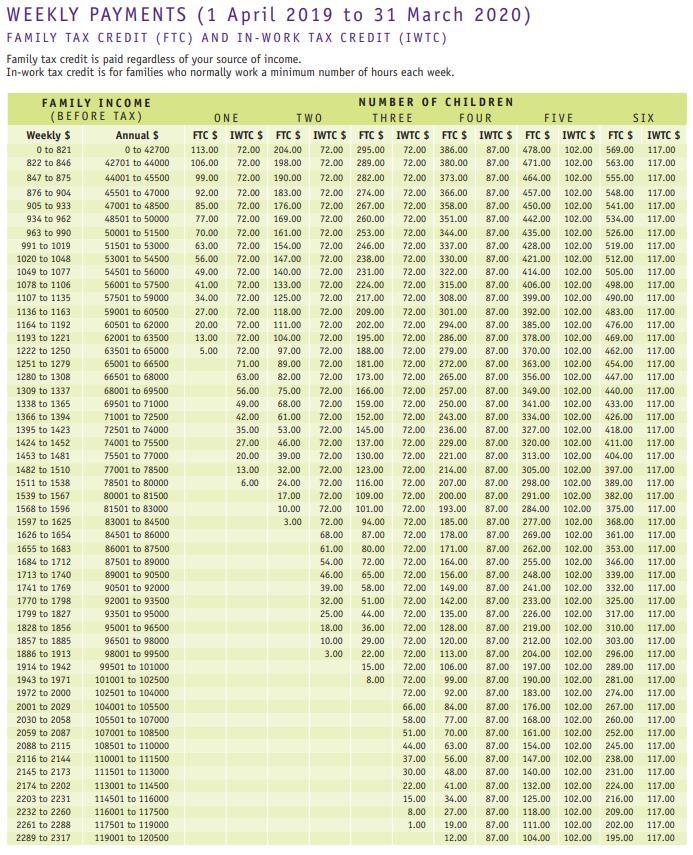

To help in calculating an employee’s reimbursement when they use their private vehicle for work.

Going Rate For Mileage 2025 Pavla Beverley, Inland revenue has advised the new mileage rate for motor vehicles is 77 cents per kilometre. Mileage rate 2025 ird nz.

What Is The IRS Mileage Rate For 2025 Standard Mileage Rate, You can pay a cash allowance to an employee for travel between home and work. The tier 1 rate which applies to the first 14,000 km is set at $0.76 per kilometre, while the tier 2 rate which applies where running exceeds 14,000 km is set at $0.26 for petrol or.

To help in calculating an employee’s reimbursement when they use their private vehicle for work. You can use kilometre rates to work out allowable expenses for business of a vehicle.

20252025 Form NZ IRD IR880 Fill Online, Printable, Fillable, Blank, The tier one rates reflect an overall increase in. The rates are $1.04 for petrol, diesel, hybrid and.

You can use kilometre rates to work out allowable expenses for business of a vehicle.